Investment

Philosophy

Renfrew Capital Management believes that the larger the pool of potential investments, the greater the opportunity an active manager has to add value. We believe that stocks and markets have many attributes that are related to potential out performance, and that a successful investment approach must be multifaceted and highly adaptable. We believe that objectivity is crucial to investment success.

Different Types of Investment

Life is full of tough choices. One of the toughest is how and where you invest your hard-earned money. To make the best decision for you, you need a basic understanding of how the most popular investment vehicles work. Here’s a crash course.

When you buy a bond, you’re essentially lending your money to an organization. It could be a government, municipality or company. In return for your loan, they agree to pay you interest on your money until the bond matures. At maturity they’ll pay you back the principal. If you aren’t the original holder of the bond, you may gain or lose money on the purchase price of the bond itself.

The main attraction of bonds is their relative safety. If you buy bonds from the U.S government, for example, your investment is basically risk-free, but your returns will be low, too. When you buy a bond from a large company with a stable history, these are often called investment grade bonds. Generally they’ll offer slightly higher returns than comparable government bonds, but with increased risk. Overall, compared to other securities, well-rated bonds carry lower risk and lower returns.

When you purchase stocks in a company, you become a part owner of the business. Although you won’t have anything to do with the actual running of the company, if it is a dividend-paying stock, you’ll receive a share of the profits that the company pays to its owners. This is not always the case though - some stocks don't pay dividends. Then the only way that you can profit is if the stock increases in value and you sell it.

Compared to bonds, stocks fluctuate in value regularly, sometimes on a daily or even hourly basis. The upside of that volatility is the potential for high returns. But you’ll have to take on the risk of losing some or all of your investment.

When you buy into a mutual fund, you’re pooling your money with other investors to pay a fund manager who’ll select and manage a group of securities for you - typically a mix of stocks, bonds and other smaller investment vehicles. You share in any growth or loss, and in any income paid by the fund’s investments. Each fund invests in anywhere from a few dozen to several hundred different securities, so it’s a convenient way to diversify. Because mutual funds are run by a pro, they may be a great way to invest if you don’t have the time or experience often needed to choose individual investments. Details about a fund’s investment strategy, the fund manager, fund expenses and more can be found in the fund’s legal disclosure, called a prospectus. It’s a good idea to read it thoroughly before investing.

Money market funds are generally lower risk and tend to invest only in fixed-income securities. Money market funds may be a good bet if you want to put money away for a rainy day and still see some growth on it. As with any other investment, there is still a degree of risk.

If you’re looking for an even safer option than a money market fund, a bank CD might be for you. Typically issued by banks, a CD is a fixed deposit that the bank will hold for an agreed length of time in return for a competitive rate of interest. CD’s are insured by the FDIC, so they’re very safe if you stay within the coverage limits, but your returns will be comparatively low.

Investment Process

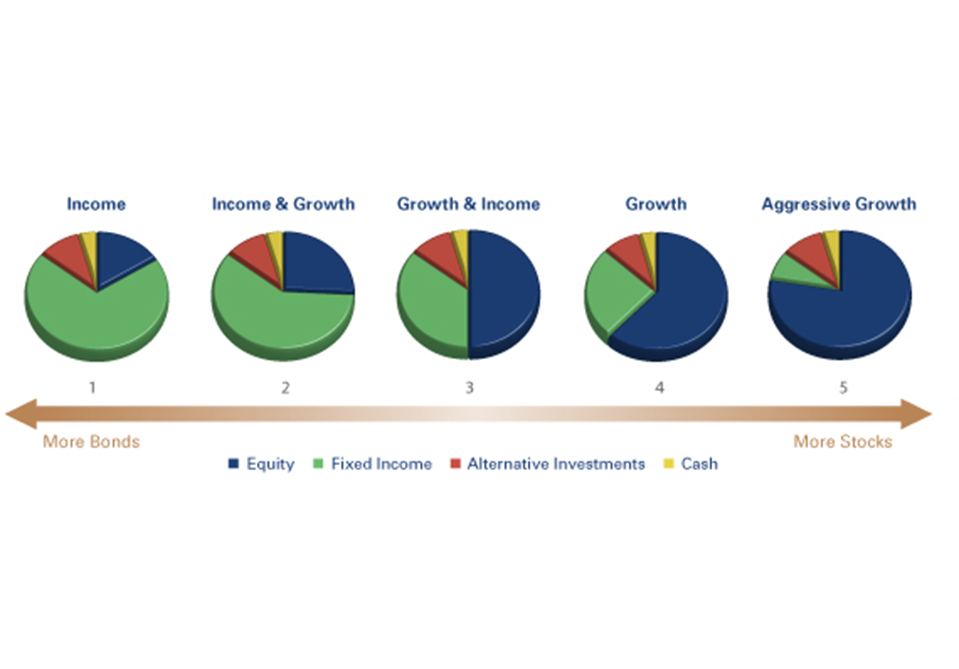

The underlying foundation of our investment philosophy is the construction of a globally diversified portfolio based on strategic asset allocation. Strategic asset allocation is a strategy that divides up a portfolio among major asset classes (equities, bonds, cash equivalents, and alternative investment vehicles) in proportions that are consistent with an investor's long-term financial goals and objectives, establishing a "base policy mix". This mix of assets is based on expected rates of return and risk for each asset class.

At Renfrew Capital Management, we construct and maintain our core asset allocations through the use of both fundamental and quantitative data. When determining an asset allocation, we review the last ten years of data history with the mindset that the last decade is more relevant to the anticipated decade as opposed to using the entire history of the market. We employ a stringent due diligence process in selecting what we believe are the best possible investment solutions and an unwavering objectivity enforces accurate positioning in portfolios, to achieve long-term investment goals.

Studies examining investment portfolios over time found that asset mix — the combination of money market, income and growth investments — accounts for more than 90% of a portfolio's return over the long term. In other words, the allocation of investments to each asset class is far more important than the selection or timing of individual investments. Although the mix between equities and fixed income, broadly defined, is typically the most important asset allocation decision, proper diversification requires that a portfolio be allocated among several distinct asset classes including alternative investments. Within the broad equity asset class, examples of "sub-asset classes" would include large capitalization equities, small capitalization equities, domestic equities and foreign equities. Within the broad fixed income asset class, sub-set classes vary according to maturity/duration (e.g. short, intermediate, long-term); type of issuer (e.g. government, corporate, municipal); and credit quality.

Structured, Not Static

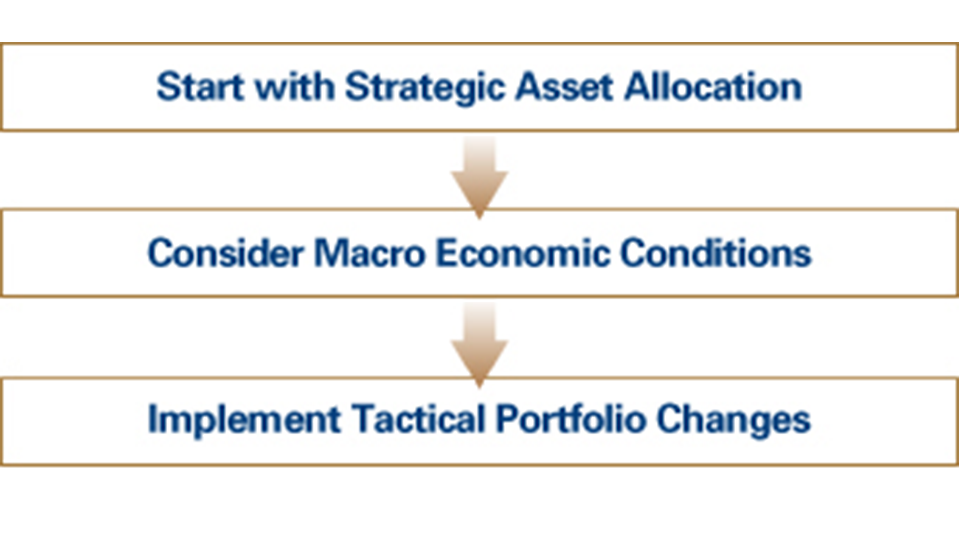

Our portfolios are carefully structured and designed for long-term investing — with low expense ratios— but they are not static. We use a top-down approach, considering both a macro view of the economy and the markets, as well as a careful analysis of investment fundamentals. In simple terms, this means that we continuously assess and reassess our strategic allocations, adjusting them when necessary.

While we firmly believe in a long-term approach to investing, we do not subscribe to a "buy and hold" philosophy. Rather, we take steps to adjust portfolios, recognizing that it is important to be proactive, without compromising the integrity of the underlying strategy of a given model. With our long-term framework in place, our focus is then three-fold:

Our tactical overlay essentially helps us determine which areas to under or over-weight based on market conditions. We will recommend a portfolio change where we can either reduce the risk in the portfolio or potentially add a higher rate of return, given a certain level of risk. In stepping through this process, our Investment Committee focuses a great deal on top down (macro environment).

The return and principal value of an investment will fluctuate so that, when redeemed, they may be worth more or less than their original cost. Economic and market conditions effect the performance of an account. Since no one investment program is suitable for all types of investors, this information is provided for informational purposes only. You should review your investment objectives, risk tolerance and liquidity needs before selecting a suitable investment program. Not FDIC Insured

Investment Banking

Capital Markets

The capital markets team at Renfrew Capital Management is focused on servicing both premier buy-side institutional asset managers and corporate clients.

For institutional asset management clients, we provide liquidity, execution, high-quality idea-generating research, and access to corporate management teams. Our institutional coverage includes relationships with over asset management companies all over the world.

To corporate clients we bring access to investor capital, broad distribution capabilities and financial markets advisory. Renfrew Capital Management is a leader in financing growing middle-market public companies across various industry verticals, including Healthcare & Life Sciences, Yield-Oriented Securities (BDCs, REITs, MLPs), Energy, Power & Infrastructure, and Telecom, Media & Technology.

Wealth Management

Renfrew Capital Management has a long and distinguished history of serving the financial needs of individuals, families, and corporations. Our wealth management professionals are committed to understanding clients’ needs and helping them to determine both long-, and short-term investment goals and objectives.

Why Choose Us?

Renfrew Capital Management's investment philosophy is founded on these observations:

- Markets are inefficient because many investors do not always act rationally

- Investors have "mental models" of how stock prices are set, but these frequently change due to both external and internal (psychological) factors

- Markets are adaptive, investment strategies go in and out of favor, and risk/reward relationships change over time

This suggests value-added can best be generated by:

- Knowing the value of different pieces of information at different points in time in an objective, quantified and disciplined way

- Applying this value to a broad opportunity set

- Employing dynamic investment strategies adapted to the current market environment